Wellness Tracker New Feature: Vax Card Management

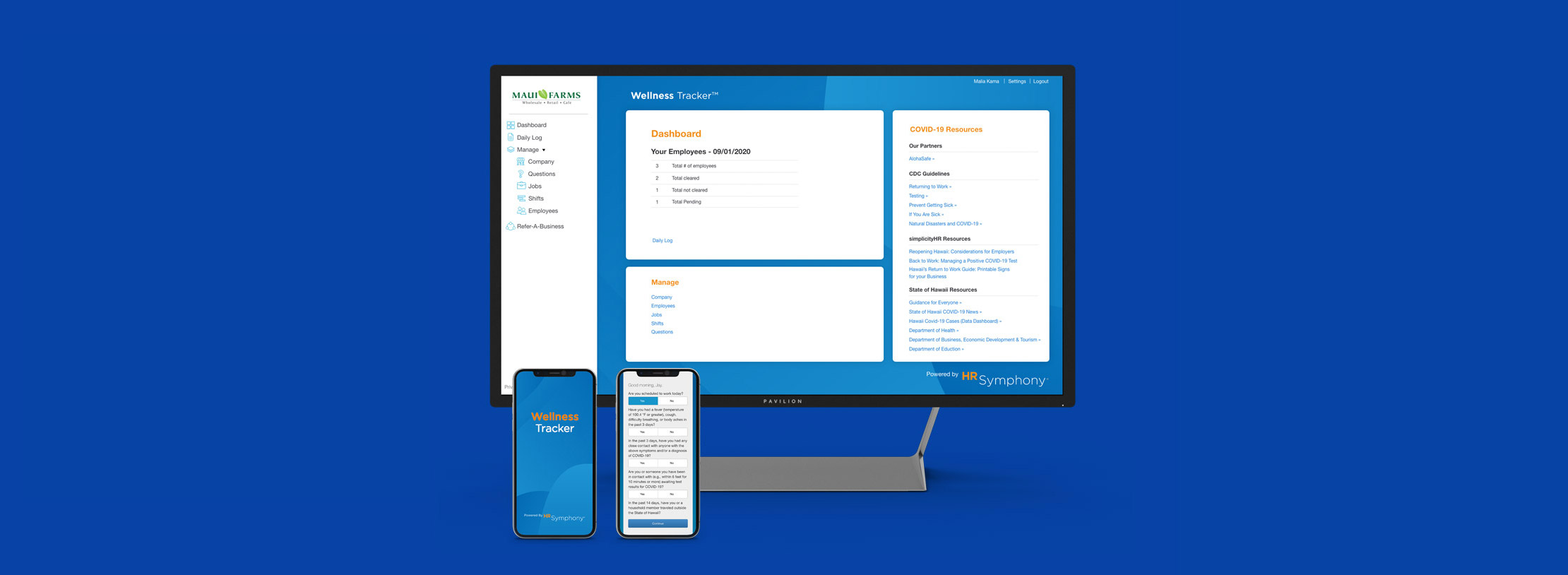

Throughout the pandemic, ALTRES has been passionate about developing tools and resources to help reduce the spread of COVID-19 in our community. With the new City & County of Honolulu vaccination and testing regulations in place, our teams have been working non-stop to develop new features to help businesses stay compliant and mitigate the risk of COVID-19 in the workplace. Wellness Tracker by ALTRES provides companies and organizations a tool to offer self-screenings for their employees and customers. And now with a newly added feature, businesses have the ability to manage vaccination status or test results with ease. With Wellness Tracker, customers, employees, and vendors may simply upload a copy of their vaccination cards or proof of negative test results, allowing them to safely enter your place of business. Wellness Tracker is provided free to the community by the ALTRES…