Payroll is an essential but often stressful part of running a business. Mismanaged payroll can result in hefty penalties, timely rework, and even hurt your relationship with your employees.

In fact, 49 percent of employees will start looking for a new job after experiencing only two problems with their paycheck, according to a new survey from The Workforce Institute.

At simplicityHR, we help hundreds of Hawaii businesses with their payroll needs—from small mom-and-pop shops to large corporations. Here are some of the most common (and costly!) payroll mistakes we help them to avoid.

Running payroll late

If there’s one thing employees count on, it’s getting paid on time. Hawaii employers must pay their employees at least twice during each calendar month and within 7 days (not business days) after the end of each pay period (Section 388-2(a)(b), Hawaii Revised Statutes of the Payment of Wages and Other Compensation Law).

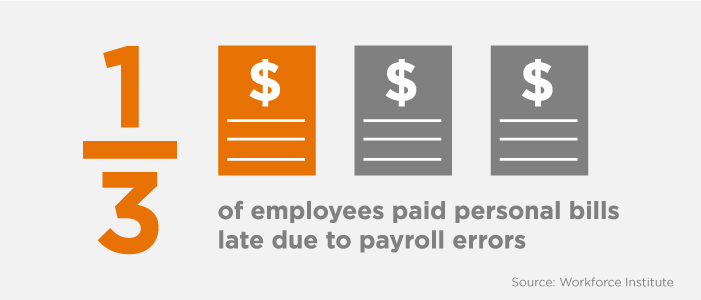

Running payroll late can not only result in costly penalties and back wages (plus interest!), it can also damage the hard earned trust of your employees.

With nearly half of Hawaii’s residents living paycheck to paycheck, just one late paycheck can affect your employees’ ability to pay their bills, buy food for their families, pay rent, etc. Plus, do you really want a reputation for being unable to pay your employees on time?

Missing tax payments and filing deadlines

Payroll taxes might be one of the biggest headaches of running your payroll in-house. Not only do you have to withhold the correct amount of taxes (state and federal) from your employees’ paychecks, but you as an employer have to report and pay taxes, too.

Federal tax deposits may be due monthly or semi-weekly, depending on the deposit schedule you’re required to use. This has nothing to do with how often you pay your employees, but the total tax liability you report on Form 941 (See IRS Publication 15: Section 11).

Late payments can result in a failure-to-deposit penalties of up to 15 percent for federal payroll taxes; up to 25 percent for state payroll taxes.

Download: HR Calendar

Misclassifying employees as independent contractors

As many as 20 percent of employers misclassify at least one worker as an independent contractor, instead of an employee. Why does that matter and what does it have to do with payroll?

Misclassified employees often miss out on the benefits and protections they are entitled to by law—minimum wage, overtime, unemployment insurance, family and medical leave, among other things.

Read more: Contractor or employee? Correctly classifying your workers

It also means employers may not withhold and pay the necessary taxes when they should be. The consequence? Employers may be subject to pay both the employee and employer’s share of taxes (plus penalties and interest) and any back wages owed to the employee.

Failing to keep accurate payroll records

Whether it’s an IRS audit or employee dispute about back wages, it pays to keep accurate payroll records on file. And it’s required by law. The tricky thing is knowing what information to keep and for how long.

Federal employment laws like the Fair Labor Standards Act (FLSA) and the Age Discrimination in Employment Act (ADEA) require most employers to keep payroll records on hand for at least three years; the IRS requires you keep them for at least four years. But Hawaii law is more stringent still.

Under Hawaii’s Wage and Hour Law, employers must keep payroll records for at least six years and maintain the following information:

- Employee’s name, address, social security number, occupation, and rate of pay

- Hours worked each day and each workweek

- Total straight time and overtime wages

- Amount and purpose of additions to or deductions from wages

- Total wages paid each pay period, date of payment, and pay period covered

- Date of hire and termination

Recordkeeping requirements can vary by industry, so it’s best to check with your HR and/or tax advisor.

Sign up for our newsletter

Sign up for our monthly HIVE newsletter and get tips for finding a job, managing a business and advancing your career right in your inbox.

Payroll is an essential but often stressful part of running a business. Mismanaged payroll can result in hefty penalties, timely rework, and even hurt your relationship with your employees.

In fact, 49 percent of employees will start looking for a new job after experiencing only two problems with their paycheck, according to a new survey from The Workforce Institute.

At simplicityHR, we help hundreds of Hawaii businesses with their payroll needs—from small mom-and-pop shops to large corporations. Here are some of the most common (and costly!) payroll mistakes we help them to avoid.

Running payroll late

If there’s one thing employees count on, it’s getting paid on time. Hawaii employers must pay their employees at least twice during each calendar month and within 7 days (not business days) after the end of each pay period (Section 388-2(a)(b), Hawaii Revised Statutes of the Payment of Wages and Other Compensation Law).

Running payroll late can not only result in costly penalties and back wages (plus interest!), it can also damage the hard earned trust of your employees.

With nearly half of Hawaii’s residents living paycheck to paycheck, just one late paycheck can affect your employees’ ability to pay their bills, buy food for their families, pay rent, etc. Plus, do you really want a reputation for being unable to pay your employees on time?

Missing tax payments and filing deadlines

Payroll taxes might be one of the biggest headaches of running your payroll in-house. Not only do you have to withhold the correct amount of taxes (state and federal) from your employees’ paychecks, but you as an employer have to report and pay taxes, too.

Federal tax deposits may be due monthly or semi-weekly, depending on the deposit schedule you’re required to use. This has nothing to do with how often you pay your employees, but the total tax liability you report on Form 941 (See IRS Publication 15: Section 11).

Late payments can result in a failure-to-deposit penalties of up to 15 percent for federal payroll taxes; up to 25 percent for state payroll taxes.

Download: HR Calendar

Misclassifying employees as independent contractors

As many as 20 percent of employers misclassify at least one worker as an independent contractor, instead of an employee. Why does that matter and what does it have to do with payroll?

Misclassified employees often miss out on the benefits and protections they are entitled to by law—minimum wage, overtime, unemployment insurance, family and medical leave, among other things.

Read more: Contractor or employee? Correctly classifying your workers

It also means employers may not withhold and pay the necessary taxes when they should be. The consequence? Employers may be subject to pay both the employee and employer’s share of taxes (plus penalties and interest) and any back wages owed to the employee.

Failing to keep accurate payroll records

Whether it’s an IRS audit or employee dispute about back wages, it pays to keep accurate payroll records on file. And it’s required by law. The tricky thing is knowing what information to keep and for how long.

Federal employment laws like the Fair Labor Standards Act (FLSA) and the Age Discrimination in Employment Act (ADEA) require most employers to keep payroll records on hand for at least three years; the IRS requires you keep them for at least four years. But Hawaii law is more stringent still.

Under Hawaii’s Wage and Hour Law, employers must keep payroll records for at least six years and maintain the following information:

- Employee’s name, address, social security number, occupation, and rate of pay

- Hours worked each day and each workweek

- Total straight time and overtime wages

- Amount and purpose of additions to or deductions from wages

- Total wages paid each pay period, date of payment, and pay period covered

- Date of hire and termination

Recordkeeping requirements can vary by industry, so it’s best to check with your HR and/or tax advisor.

Sign up for our newsletter

Sign up for our monthly HIVE newsletter and get tips for finding a job, managing a business and advancing your career right in your inbox.